In their separate ways, they predict continued economic growth, a leveling of the real estate market, and a gradual increase in interest rates towards year end or maybe 2015. Nothing especially surprising, but a comforting consensus nevertheless.

In most realtors’ minds, I think it is fair to say that Zillow, when it comes to specific home values, has been more of an inaccurate annoyance rather than an indicator of value. What shined through during Zillow’s presentation however was the depth of their data and how closely their home value curve follows the Case Schiller curve on a macro scale.

In addition to the familiar housing value graph, Zillow is producing affordability indexes that appear to be very useful in projecting the future buying power of the average home buyer on both a local and national scale. That information is now free to anyone with internet access and the desire to use it.

When calculating this index, Zillow factors in:

- Prevailing mortgage rates

- Median Household income

- Median home values

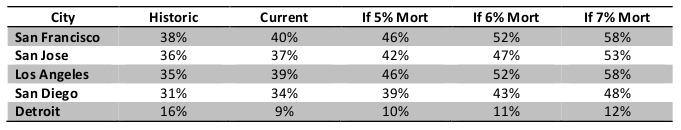

Since the prevailing mortgage rate is the variable most likely to change, and from a risk perspective, an upward change creates the most risk for a lender, it is very helpful to see how much “cushion” we have. Zillow has prepared calculations that show what percentage of a median household income is necessary to buy the median home. The “Historic” column shows the average percentage of income that was required to purchase the median home during the 1985 – 2000 time period for the specific local. The “Current” column shows what it is now, and the other columns show what percentage of income would be necessary to purchase the median home if the prevailing mortgage rates were the rate that heads that column.

The table shows that the west coast of California is a tad more (relatively) expensive right now than the period from 1985 – 2000, whereas Detroit is much more (relatively) affordable than the period from 1985 – 2000 and will still be more affordable even if mortgage rates go to 7%. If I were buying 100 homes, I might consider a trip to Detroit, but if I am buying or investing in 1 home, and then I would stay in California, but realize that prudence is in order because an increase in mortgage rates will put a damper on prices.

Zillow is projecting that San Diego home prices will increase by about 7% in 2014. That’s a lot less than the last two years, but very encouraging for housing and the economy in general. It seems to fly in the face of the table above, but inertia is a formidable force and the projections for mortgage rates are that they will be stable for at least the majority of 2014.

Projections are not always right of course, and they certainly do not anticipate a “Black Swan” event, but it appears that a bet on equal to improved real estate values in 2014 for San Diego is reasonable.