Federally insured Certificate of Deposits (CD) have traditionally been a comforting option for conservative investors. As long as the FDIC is solvent and your savings are not in excess of the insured limit, it is a worry free form of investing. A CD is reasonably liquid and they are safe.

Just like any investment option, it is not a good idea to have all your eggs in one basket. Stocks have been on a tear for the past few years, but that was after they got hammered in 2008 and 2009.

The problem comes when retirees have allocated all their savings to CD’s and modeled their future on a 5% return and the “safe” market of T-Bills or CD’s does not meet their targeted yield.

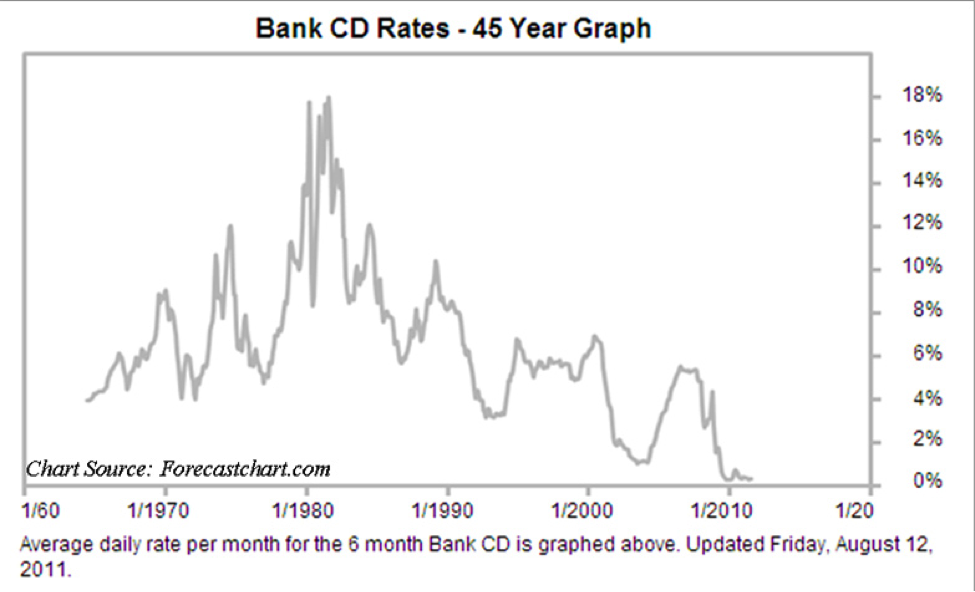

When you look at the graph above, it is easy to see why older investors have an affinity for CD’s. They have grown up in a period where their parents were adequately served by responsible saving and conservative investing.

When you factor in inflation, the story looks like this:

Beginning in the mid 60’s, CD’s marched down to negative inflation adjusted yields and spiked sharply positive (when Reagan became president) in the early 80’s and have drifted down ever since.

No one knows which way rates are headed in the future; many think we will have massive inflation and many think we will deflate. What we do know is that we are living longer and typically spending more. We also know that not all investments are good all the time. The financial planner’s mantra of asset allocation and diversification is based on decades of experience and is very hard to quibble with.

CD’s have a place in your portfolio as do stocks, bonds and alternative investments such as Trust Deeds, but none of them should be the only egg in your basket.