By Lily Leung

August 31, 2013

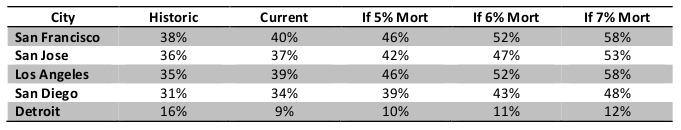

Nearly 30 percent of San Diego County homes sold in July were purchased with cash, much higher than the historical average of 16 percent. What does the continuing high level of all-cash buyers tell about the state of San Diego’s housing market?Our U-T Housing Huddle panel, a group of real estate insiders, chimed in:

•Murtaza Baxamusa, directs planning and development for the Family Housing Corporation, of the San Diego Building Trades in Mission Valley:It is indeed unfortunate for first-time home-buyers that speculative buyers consist of almost a third of home purchases in San Diego. This is because the latter drive up prices, often come from foreign sources, and outcompete bids with traditional financing. Some may argue that the presence of cash buyers signals strong market demand. But speculative buyers have blown bubbles in the past, and this time may be no different. If housing costs spiral unsustainably faster than family incomes and local employment growth, homes become poker chips for international gamblers, than dwelling units for San Diego families.

• Michael Lea, real estate professor at the Corky McMillin Center for Real Estate at San Diego State University: The high percentage of all cash transactions for San Diego County homes reflects the influence of investors in the market. Wall Street firms have created large funds to purchase homes – either to flip or to rent. Initially these funds focused on distressed houses but as that portion of the market shrank they turned their sights to non-distressed and higher priced homes. This reflects the volume of funds raised and the need to deploy the money. San Diego is an attractive investor market with significant appreciation potential given the depth of the downturn and lack of new supply.

• Linda Lee, president of the Greater San Diego Association of Realtors: Thirty percent is common in many markets across the country. A recent National Association of REALTORS® study shows there has been a tremendous increase in cash buyers since the housing downturn. The study found more than 60 percent of international buyers pay cash for properties. Downsizing baby boomers often have enough equity left from their sale to pay for their next house or condominium with cash. We’re also seeing a larger percentage of cash buyers in the market because of tighter lending guidelines. Some clients have bought properties with cash and they finance after closing, so the buying process is less stressful.

• Marco Sessa, chairman of the Building Industry Association of San Diego County and senior vice president of Sudberry Properties : There are several drivers for all-cash buyers. 1) The US dollar is cheap to foreign investors; 2) Investors are more likely to pay cash to maximize returns; 3) Move down buyers/empty nesters generally desire to lower their debt and they have significant equity from the larger home they are leaving; and 4) Other buyers who view debt negatively and are frustrated with low returns on other investments. As home values continue to rise and macro-economic conditions improve in the US, it is likely that the first two drivers will decrease and the number of all-cash buyers will return to more historical levels.

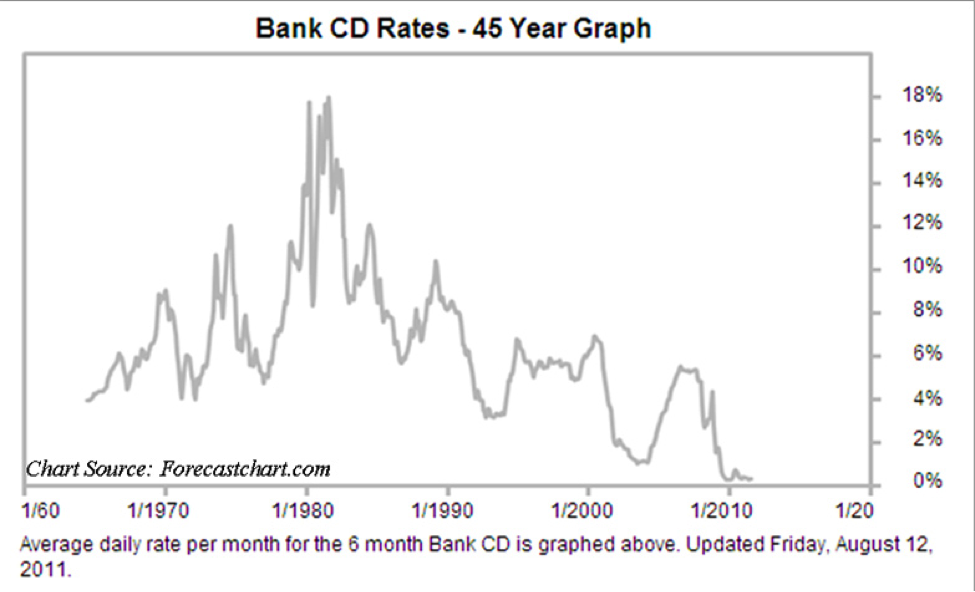

• Robert Vallera, senior vice president of Voit Real Estate Services in San Diego: This attests to the health of our rental market. Many of these buyers are investors who are responding to the demand for rental housing. Unlike a decaying Detroit or overbuilt Miami, San Diego has enough economic vitality to create effective rental demand for our housing stock. An even larger factor is today’s Fed-suppressed interest rates. Cash savings generate almost no interest income and bonds are vulnerable to large capital losses when interest rates revert to historical norms. Rental housing investments with carefully controlled debt or no debt should provide a superior return to bonds with less interest rate or inflation risk.

•Kurt Wannebo, real estate broker and CEO of San Diego Real Estate and Investments: First, it’s important to understand where most of this money is coming from. It’s both foreign and institutional, but in either case they are all mostly investors. My knowledge of these cash buyers is that they are all bullish on certain geographic areas such as Southern California. They are switching to buy-and-hold models, where in any case they will win. If interest rates rise, they will see rental income rise. If not, they anticipate valueappreciation on their investments. These are longer term strategies that investors are starting to feel, are a safer place to place money into.

My Take:

•Ron Bedell, CEO/President of Pacific Horizon Financial:

Dissecting the panels reasons gives us the following responses:

· International Speculators, Gamblers or Investors: 5 of 6

· Wall Street, Domestic, or Rental Investors 3 of 6

· Downsizing Homeowners 2 of 6

· Tighter lending standards 1 of 6

· Poor returns on other Investments 2 of 6

· Exchange rate of the dollar 1 of 6

The primary finger points to Investors and I agree, but I don’t think foreign investors are the primary driver. Wall Street has had an impact, but my guess is that our local folks have been the primary participants.

Since the historical average is 16% for cash buyers vs. the current 30%, that means that we now have twice as many cash transactions as the norm. Since most of the fixer homes are bought with cash; that makes sense. (PHF uses a TD for its fixer purchasers, but not all do. Many allow a purchase without a title policy and on the court house steps etc. and place the lien after the purchase.) These same houses are then quickly sold to end users and most of them use mortgages.

Our dollar has risen over the last year vs. most other currencies and has discouraged many Canadian’s from buying this year vs last year. The exchange rate is worse and the prices have risen.

Downsizing homeowners should be the same percentage in this market as the historical norm, so that is not a factor for an increasing percentage.

Banks are certainly tougher, but normally you either have cash or you don’t, so again not a factor.

Poor returns elsewhere is a possible reason, but a bond buyer is usually not a real estate investor. Moreover, low interest rates and leverage is a killer combo for real estate.

So my conclusion is that our home town boys have been making an impact on the all-cash purchases and that is good news, but fairly irrelevant going forward. The metric lenders need to keep in mind is what is that house worth next year? My guess is that it will be at least steady, so it’s a good time to lend.